Regulations

FCPA Compliance Software

Benefit from a centralized, risk-based approach to compliance with Anti-bribery and Corruption Regulations, including the FCPA. Gain a thorough understanding of your overall anti-bribery and corruption risk posture and operate with the confidence that you have robust and effective procedures in place.

Why GAN Integrity

GAN Integrity is how compliance teams get the tools and expertise to stay ahead of ABAC risk. With less effort but more reach, you finally get a better way to do your good work.

See everything – Gain a comprehensive view of your anti-bribery and corruption risks in one centralized platform.

Adapt to anything – Utilize a dynamic solution that adapts to regulatory changes and evolves with your program.

Get all the help you need – Receive dedicated support from GAN Integrity’s team of experts.

Understanding The Foreign Corrupt Practices Act (FCPA)

The Foreign Corrupt Practices Act (FCPA), enacted in 1977, is a U.S. federal law aimed at preventing bribery and corruption in international business transactions. It has two main provisions:

Anti-Bribery Provisions: These prohibit U.S. individuals, companies, and certain foreign entities from bribing foreign government officials to obtain or retain business. This includes offering, paying, promising to pay, or authorizing the payment of money or anything of value to influence the actions of a foreign official.

Accounting Provisions: These require publicly traded companies to maintain accurate books and records and implement internal accounting controls to prevent and detect illegal payments.

The FCPA is enforced by the U.S. Department of Justice (DOJ) and the Securities and Exchange Commission (SEC). The FCPA also encourages companies to establish comprehensive compliance programs to prevent and detect bribery and corruption.

Why FCPA Compliance is Crucial

Violations to the FCPA can lead to substantial fines, penalties, and imprisonment for individuals, while companies risk reputational damage and loss of business opportunities. Adhering to the FCPA does more than just help companies avoid legal troubles and hefty fines; it also enhances their reputation for integrity. This is why having a robust compliance program is essential—it promotes sustainable business practices and paves the way for success in the global marketplace.

Key Expectations of FCPA Compliance

Prohibiting Bribery:

- The FCPA makes it illegal for companies and their personnel to influence foreign officials with improper payments.

- Compliance Tip: Implement strict anti-bribery policies and training programs detailing prohibited conduct and the legal consequences of non-compliance.

Accurate Record Keeping:

- Companies must ensure that all transactions are accurately reflected in their books and are verifiable.

- Compliance Tip: Utilize robust accounting systems that can track and report transactions transparently.

Robust Internal Controls:

- Effective internal controls are crucial for compliance, helping to detect and prevent improper payments.

- Compliance Tip: Regularly review and update internal control systems to reflect current risks and regulatory requirements.

GAN Integrity Solutions for FCPA Compliance

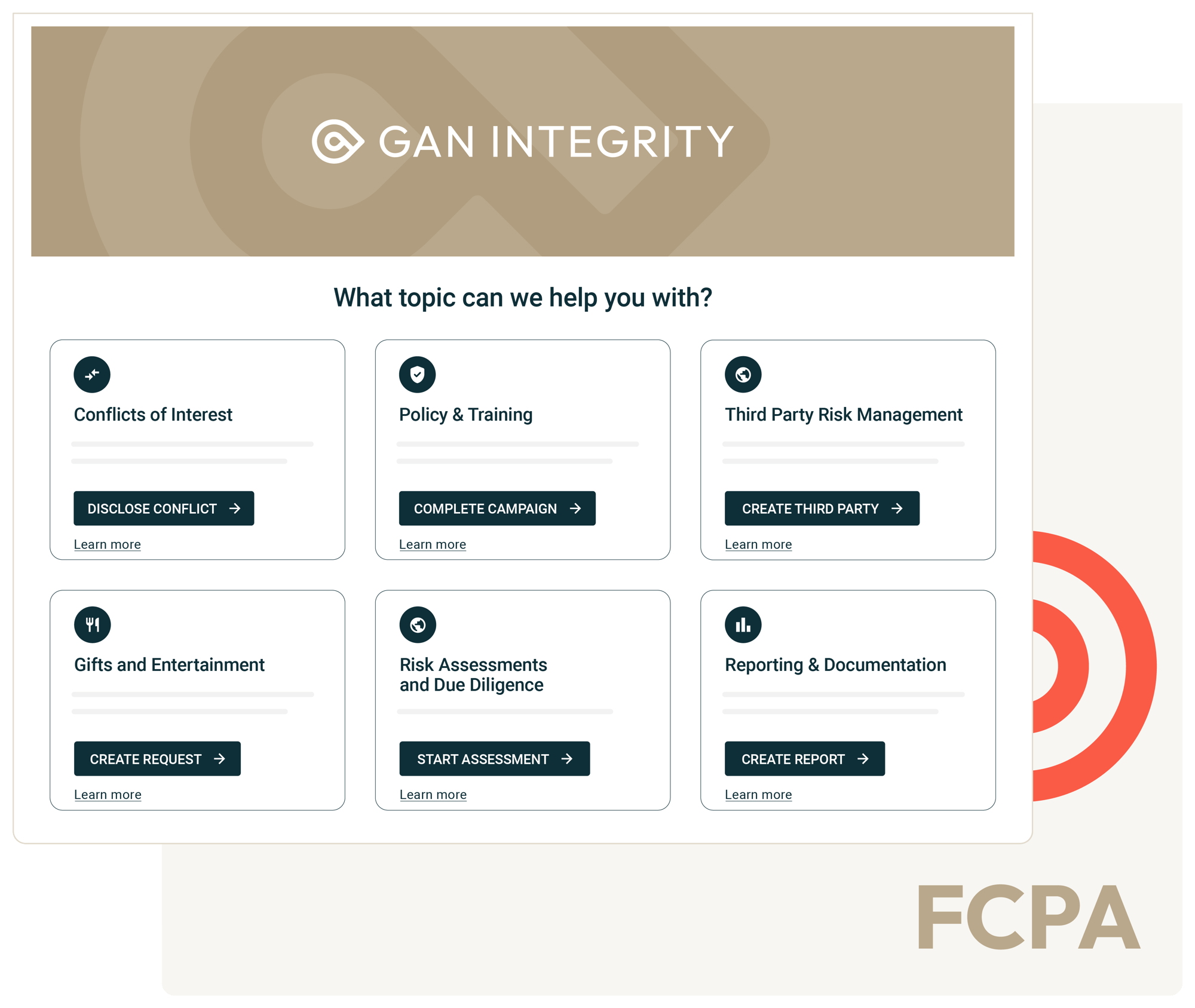

GAN Integrity’s platform is designed to support companies in maintaining robust ABAC compliance programs that meet FCPA requirements. The platform offers several key features:

ABAC Program Management

Ensure your organization upholds ethical integrity and ABAC compliance through comprehensive risk assessments, effective policy management, and continuous monitoring. Capabilities include:

- Third-party due diligence: Mitigate bribery and corruption risks with integrated questionnaires, sanctions checks, and risk intelligence data.

- Disclosure management: Consolidate and assess conflicts of interest, gifts, travel, entertainment, and political and charitable contribution disclosures.

- Reporting and documentation: Maintain a complete audit trail and detailed reporting to easily demonstrate compliance to stakeholders and regulators.

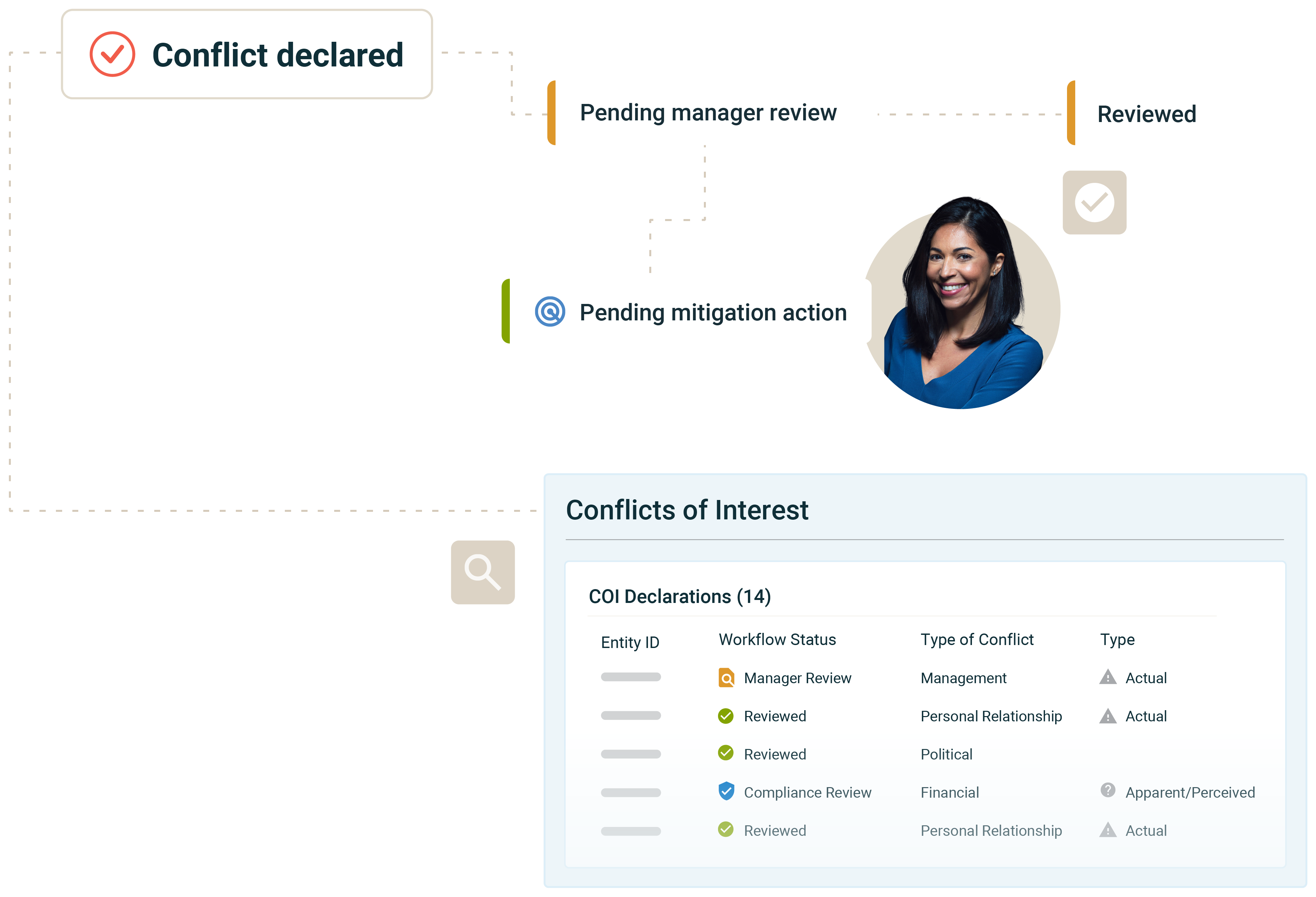

Conflict of Interests Management

Manage employee conflicts of interest disclosures with an easy to use, configurable platform. Capabilities include:

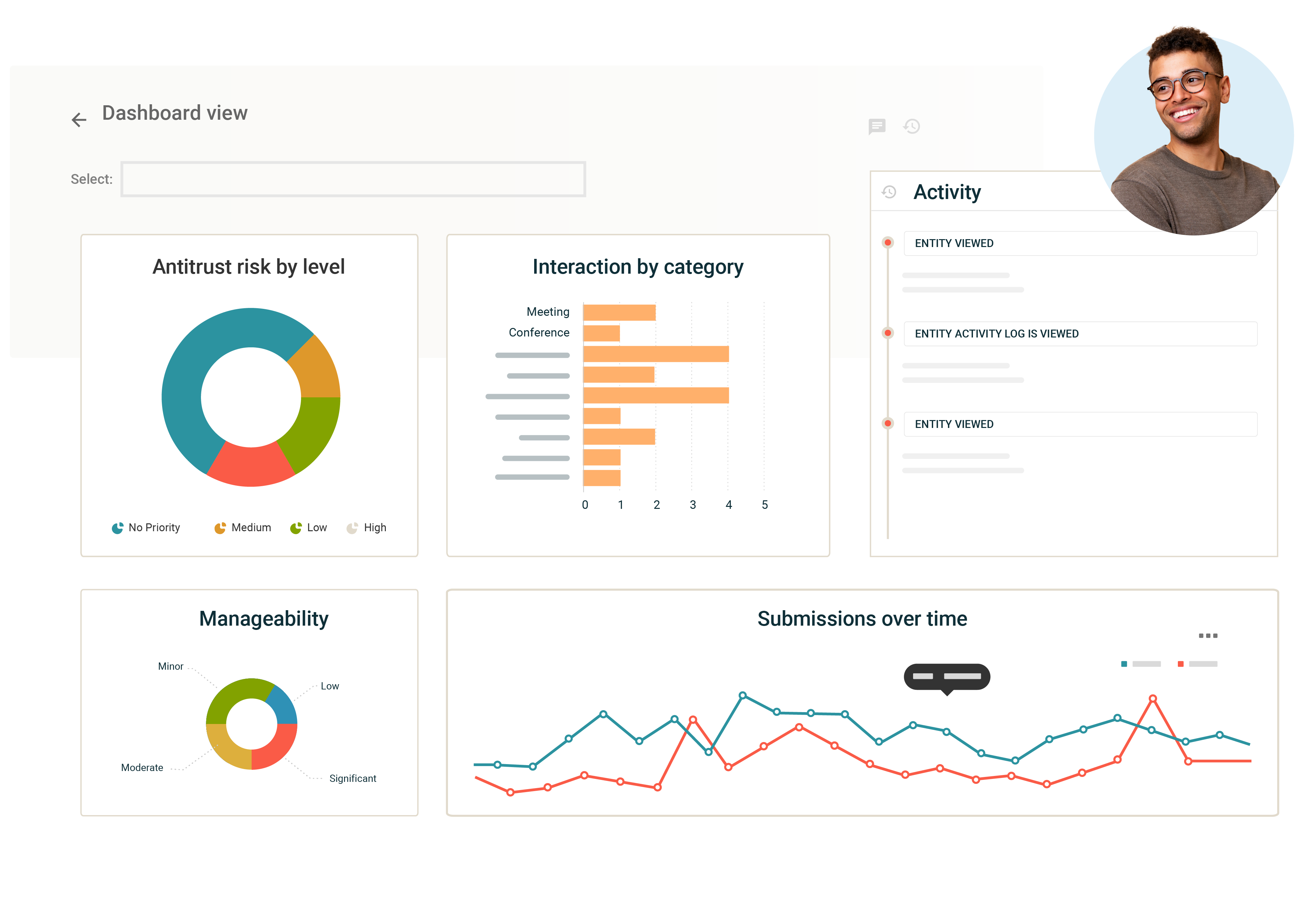

- Reporting and analytics: Role-based dashboards to identify areas of potential exposure with actions and remediation workflows to mitigate risks.

- Campaign Management: Create conflicts of interest campaigns to inform and engage employees with training, policies and regular disclosure campaigns.

- Third-party risk integration: Track conflicts of interest disclosures against third parties and suppliers for a comprehensive view of risk.

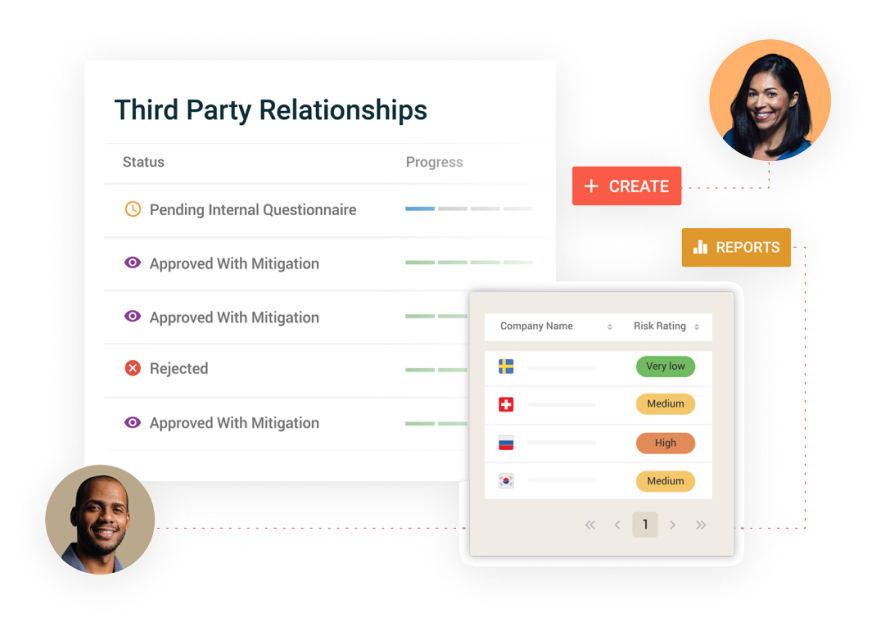

Third-Party Risk Management

Manage risks associated with third parties and assess these against relevant laws and organizational standards. Capabilities include:

- Lifecycle management: Automated workflows for onboarding, risk assessment, issue management, monitoring and off-boarding.

- Integrated due diligence: Initial and ongoing screening of third parties for sanctions, adverse media, forced labor, ESG and more.

- Reporting and analytics: Executive dashboards and reports: Consolidate third party data to identify risks and potential exposure to your organization.

Disclosure Management

Consolidate your disclosures for conflicts of interest, gifts, travel, entertainment, and political and charitable donations or contributions. Capabilities include:

- Policy management: Develop and enforce comprehensive disclosure policies. Educate and engage your workforce with targeted training and policy attestations.

- Flexible disclosure process: Simplify the submission of potential conflicts of interest with user-friendly forms, ensuring easy access for employees.

- Automated approvals and reviews: Enhance compliance with automated approval and review workflows. Quickly escalate notifications to relevant stakeholders to address potential risks.

Reporting and Documentation

See everything across your compliance program, and generate reports and dashboards to demonstrate compliance program effectiveness to stakeholders and evidence to regulators. Capabilities include:

- Reporting and analytics: Executive, role-based dashboards to review the effectiveness of your compliance program initiatives.

- Evidence-based compliance: Maintain an auditable trail of all activity with the platform’s integrated and automated audit log.

- Compliance insights: See risk trends and patterns within your program, including third-party and supply chain risk, policies and disclosures.